What is Asset Allocation and Significance of it in India?

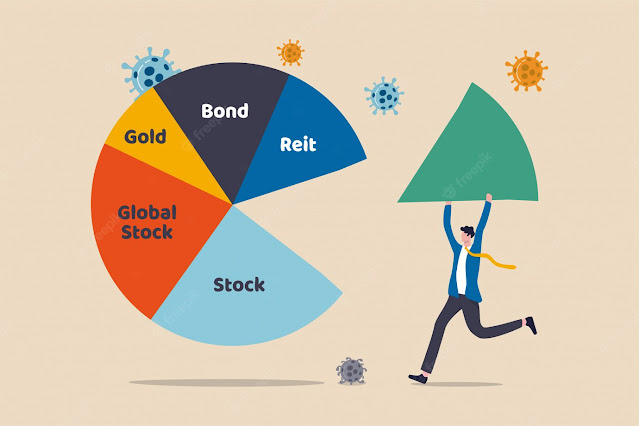

Asset allocation is a sort of investing strategy that seeks to balance risk and return by distributing a portfolio of investments among several asset classes, including equities, fixed income, cash and cash equivalents, real estate, etc. According to the hypothesis, because each asset class has a distinct connection to one another, asset allocation enables investors to reduce the impact of risk on their portfolio.

Importance of asset allocation

Different asset classes move in various ways. Rarely do all

asset classes perform together. In order to pace the market, it can be thought

that it is advisable to invest in mutual funds that are doing very well at the

moment. To anticipate the direction in which any asset class will go at any

particular time, however, is quite difficult for anyone.

For instance, gold investments may decline while stocks

rise, and vice versa. Therefore, it makes sense to spread out assets among a

variety of asset classes. This is done so that, in the event that one group of

asset classes or funds underperforms, the outperformance of the other asset

classes will balance it. One should be very cautious when investing their whole

account in a single asset class or mutual fund strategy. However, an investor's

money tends to perform better if it is dispersed among a variety of asset

types.

Factors that may have an impact on asset allocation

Choosing the ideal asset mix for your portfolio is a highly

individual process. An investor's choice of asset allocation is impacted by a

number of variables, including personal financial goals and objectives, risk

tolerance, and investment horizon. Let's examine these elements.

Time horizon

investing to reach a certain objective. Risk tolerance

varies with different investing horizons. For instance, given that sluggish

economic cycles and high market volatility tend to subside over time, an

investor with a long investment horizon may choose to invest in a portfolio

with greater levels of risk.

Risk tolerance

An investor's willingness and capacity to lose part or all

of their initial investment in the hope of higher prospective returns is

referred to as risk tolerance. Investors that are aggressive or who have a

high-risk tolerance are inclined to put most of their money at risk in order to

receive greater returns. Contrarily, risk-averse or cautious investors are more

inclined to invest in securities that protect their initial capital.

Risk vs returns

Risk and rewards are inextricably linked when it comes to

investing. The adage "no pain, no gain" perfectly captures how risk

and reward interact. Risk exists in all investments to some extent. Risk-taking

is rewarded with greater possibility for better rewards.

Comments

Post a Comment